Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on March 18, 2022

Here are the steps you need to take to start a limited liability company (LLC) in Texas:

To form your LLC, we recommend using a professional online Texas LLC formation service. This ensures accuracy, compliance, and convenience by streamlining the process, avoiding mistakes, and providing ongoing support.

We recommend ZenBusiness as the Best LLC Service for 2024

starts at $0, plus state fees starts at $0, plus state feesShould you find video content more appealing, we’ve provided a comprehensive visual tutorial on creating an LLC in Texas.

Continue reading to find a detailed guide on how to start an LLC in Texas .

Your business name is your business identity, so choose one that encapsulates your objectives, services, and mission in just a few words. You probably want a name that’s short and easy to remember, since much of your business, and your initial business in particular, will come from word-of-mouth referrals.

Once you have a few potential names, check the Texas secretary of state website to confirm they are available to register.

Simply enter your desired name into the search bar to see if it’s available or if it needs to be modified.

Additionally, every official business entity in Texas is assigned a unique entity number. If you’re searching for a specific business’s registered name, you can use the entity number to quickly locate it.

Furthermore, if you know the name of an executive associated with a business, you can search using their name to find the businesses they’re affiliated with. This can provide valuable insights into their business connections and affiliations.

If you find the name during your search, you’ll need to go back to the drawing board and choose a different name.

You should also confirm that the name you want to register conforms to Texas regulations on business names.

In Texas, your LLC name must include the phrase “limited liability company,” or one of its abbreviations (LLC or L.L.C.), and your name cannot include words that could confuse your Texas LLC with any government agency.

Additionally, your name must be distinguishable from all other business names in the state, and your name cannot imply that you’re engaged in any unlawful activity.

It’s also a good idea to check for nationally trademarked names, to ward off any potential problems later if your business expands, and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Consider these additional suggestions when choosing a name for your Texas LLC.

Once you’ve found a name that clears these hurdles, go ahead and reserve the name with this Name Reservation Request form on the Texas secretary of state website.

In Texas, your LLC needs to have a registered agent. A registered agent is a person or business authorized to accept legal, tax, and financial documents on behalf of your business, and communicate with the state on relevant matters.

The purpose of a registered agent is to ensure compliance with state laws and make sure official documents are handled in a timely manner. Having one person or entity to handle important documents helps to ensure nothing is missed, helping avoid potential potholes.

In Texas, you can be your own registered agent for your LLC, or it can be another member of the LLC. An individual who is not a member or a professional agency can also serve as the registered agent for your LLC. Another business entity can also be a registered agent.

In Texas, the requirements to be a registered agent are:

Many LLCs choose a member who is highly involved in the business to be the registered agent, although a registered agent service saves you time and ensures compliance.

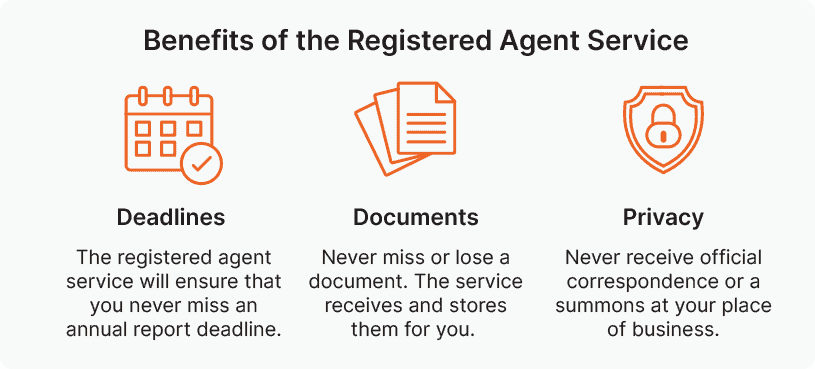

A registered agent service is a professional service that will handle official correspondence and documents for your business. Registered agents ensure that all official correspondence is handled on time and keep copies of documents for you. They also keep track of deadlines and send reminders of things you need to file, such as tax forms and annual reports.

A registered agent service will help keep you in compliance with the law and save you time by keeping track of key documents and filing deadlines. This also frees you up to focus on growing your business. The agency will also offer support if problems or questions come up.

Using an agency enables you to have flexible hours. If you’re your own registered agent, you must be personally available from 8 AM to 5 PM at your registered agent address. If you use an agency, they are available during those hours so that you don’t have to be.

An LLC offers its owner or owners considerable flexibility in terms of management. You can choose your management and operational structure.

LLC owners are known as members. In a member-managed LLC, the members run the business. In a manager-managed LLC, non-members are hired to oversee and run the business.

In a member-managed LLC, members are involved in day-to-day operations. Most LLCs are member-managed because the majority are small businesses that cannot afford to hire a management team.

Many LLC owners prefer to have a member-managed structure because they want to be in control of decision-making and directly involved in operations. Unlike corporations, most LLCs do not have boards of directors to oversee the management. This means that whoever manages the company is in control of all decisions.

![]()

In Texas, you must specify in your certificate of formation whether your LLC will be member-managed or manager-managed.

In a manager-managed LLC, non-members are hired as managers. Some members still may be managers alongside the non-member managers, or none of the members can be managers. In this structure, any members who are not managers are passive investors and have no role in the operations of the company.

This structure works best when some or all of the owners want that passive ownership, or if there are a large number of members – too many to all effectively manage the LLC. Another reason to choose a manager-managed structure is when members simply don’t have management skills. Having a great business idea and the capital to start a company does not necessarily mean that someone can run a company. In such cases, hiring professional managers can give the company a better chance of success.

To make your LLC official, you’ll need to file a Certificate of Formation with the state. This is the legal document that officially creates your LLC as a legal entity in Texas. The Certificate of Formation includes information about your LLC, such as its address, owners, management structure, and registered agent information.

In Texas, the process to file the certificate of formation is quite simple. The crucial first step is gathering the required information about your new LLC, before proceeding with the filing itself.

Here are the steps you’ll need to take to create your new business entity:

Find the Texas certificate of formation form here. You’ll need to register for an account on the site before you can access the form. It’s easiest to fill out the form online and file immediately, but you can also download it, fill it out and mail it in.

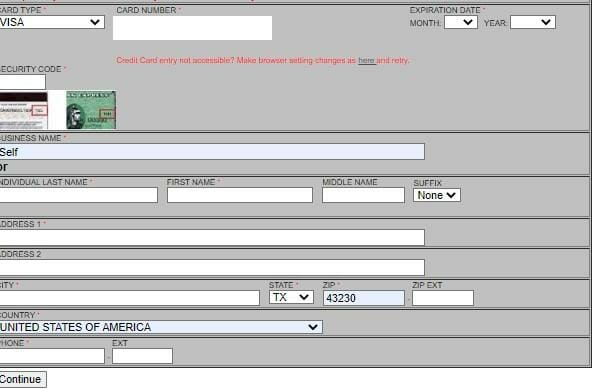

First, register for an account on the website. You’ll have to fill out your credit card information to continue, but you will not be charged until you file your certificate of formation.

Then you will select register a new business, and follow the prompts that take you through the form specifying the following information:

When filling out your articles of organization form, be sure to check and double-check that all the information is accurate and up-to-date. Maybe you’ve just moved, or use your middle initial in official documents, such as with your bank account. If you get it wrong now, changing it later can be a real pain. So accuracy is crucial.

![]()

Once you have verified the information you filled out, you’ll be prompted to pay the filing fee, which in Texas is $300.

Texas Secretary of State Contact Info

Here’s the Secretary of State website. Contact the secretary of state’s office at (512) 463-5555.

Their mailing address is:

Business & Commercial Section

Secretary of State

P.O. Box 13697

Austin, TX 78711-3697

Do I need an attorney to file a certificate of formation in Texas?

You do not need an attorney to file a certificate of formation in Texas. You can easily file online yourself, or use a business formation service. ZenBusiness’s online LLC formation service will enable you to form your LLC in just a few minutes.

How do I amend my LLC certificate of formation?

You can file a certificate of amendment for a fee of $150.

How do I get a copy of my certificate of formation in Texas?

You can request a copy of your certificate of formation on your account on the secretary of state website or by requesting it through the following methods:

By phone: (512) 463-5578

By mail:

Certifying Team

Secretary of State

P. O. Box 13697

Austin, Texas 78711-3697

An operating agreement is not required in Texas but is highly recommended. It is not filed with the state, but instead kept in your LLC’s records and used to resolve disputes, even in court.

We offer a free LLC Operating Agreement template for both single member and multi member LLC.

An LLC operating agreement is an important legal document that details who owns the business and provides essential information pertaining to member duties. An LLC operating agreement establishes the financial relationship between members and the basics of the working relationships between those members and the managers who oversee daily operations.

It’s advisable to hire an attorney to ensure your operating agreement is thorough and legally binding.

The operating agreement should clearly define:

If the LLC has a board of directors, the operating agreement will also include the role and responsibilities of the board members and how they are compensated.

An LLC operating agreement provides legal and financial recourse for a number of situations. If conflicts arise between LLC owners pertaining to any of the above issues, the operating agreement will provide clarity and guidance.

Though Texas has default rules on the books that address some of the potential challenges that might arise between LLC members, the LLC operating agreement has the potential to override such presumptions.

In Texas, forming an LLC doesn’t require a business license, but you’ll need to follow Texas state procedures, as you may need local, state, or federal permits depending on your type of business. Fees for these vary, but most costs are minimal.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration (OSHA), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific permits. Refer to the SBA guide for federal licenses and permits to determine if your business activities are regulated by a federal agency.

Even though a general business license might not be necessary to run a business in Texas, certain industry-specific ones might be needed. For instance, any enterprise involved in the sale of alcohol should possess a license from the Texas Alcoholic Beverage Commission. The specific licenses and permits required for your LLC could vary based on its location.

Comprehensive details regarding the industries that require licenses and permits can be found in the Texas Business Licenses & Permits Handbook. The Texas Economic Development Business Permit Office administers these licenses and permits, and applications can be submitted through the Governor’s Small Business Resource Portal.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties. If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

We recommend using MyCorporation’s Business License Compliance Package. They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

Your Texas Employer Identification Number, or EIN, is like a social security number for your company, allowing the IRS to easily identify your business. It is also known as a Federal Tax Identification Number (FTIN), or sometimes for corporations it’s called a Tax Identification Number (TIN).

An EIN is used to identify US businesses and contains information about the state the company is registered in. It also identifies the taxpayers who are required to file tax returns for the business.

It is used by employers for filing taxes and is generally required for businesses when they open a business bank account.

Here are the IRS requirements for obtaining an EIN:

All EIN applications (mail, fax, electronic) must disclose the name and Taxpayer Identification Number (SSN, ITIN, or EIN) of the true principal officer, general partner, grantor, owner or trustor. This individual or entity, which the IRS will call the ‘responsible party,’ controls, manages, or directs the applicant entity and the disposition of its funds and assets. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity.

The application is free and can be found on the IRS website. The application is form SS-4, and it can be mailed to the IRS or submitted electronically. Once your information on the application has been validated, your EIN is assigned immediately. The EIN will never expire, and is never duplicated, even if you go out of business.

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account.

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

In Texas, banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN, Certificate of Formation, and other legal documents and open your new account.

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

LLCs are unique in terms of taxation as their owners have a choice about how the company will be taxed. By default, an LLC is taxed like a sole proprietorship if it has one member and a partnership if it has more than one member.

In both cases, business income “passes through” to the members, while profits and losses are reported on their individual tax returns. The LLC itself is not taxed, which simplifies the process for members. Also, losses and operating costs of the business can be deducted personally by the members. Taxes are paid at the personal tax rate of the members, although the owners may also have to pay self-employment taxes.

![]()

Note that a multi-member LLC must also file form 1065 with the IRS, which is the U.S. Return of Partnership Income. Attached to this will be form K-1s for each member showing their share of the business income.

But LLCs owners can instead choose to be taxed as a corporation. To do so, the LLC must file a document, referred to as an election, with the IRS. The LLC must then decide if it wishes to be taxed as an S corporation or a C corporation.

C-Corp status means profits are taxed at the current rate for corporations (21% as of early 2022), which is significantly lower than the typical individual taxpayer rate. But keep in mind, C-Corp shareholders, which includes members, must also pay taxes on their distributions (but not self-employment taxes). Thus, the C-Corp is subject to what is sometimes referred to as double taxation.

As with sole proprietorship and partnership status, S-Corp taxation considers the LLC a pass-through entity, which means income passes through the company and into the hands of the owners. At this point, taxes are applied at the same rate as those of individual taxpayers.

S-Corps use Form 1120S to file their taxes, which is used to report the income, losses, and dividends of shareholders. S-Corp shareholders do not pay self-employment taxes, which is the primary advantage of S-Corp status compared to sole proprietorship or partnership.

Generally, S-Corp tax status is beneficial if the company is profitable enough to pay the owners a salary and at least $10,000 in annual distributions so the owners can be taxed as employees and not pay self-employment taxes. It costs more to run an S-Corp than an LLC due to additional bookkeeping and payroll expenses. Thus, the tax benefits should be more than the additional costs for an S-Corp status to make financial sense.

In Texas, LLCs need to file a Texas annual report to remain in good standing. The fee is based on the LLC’s total revenue and it is due May 15 th each year.

| Requirement | Cost/Fee |

|---|---|

| Certificate of Formation | $300 |

| Certified Copy – Certificate of Formation | $15 plus $1 per page |

| Certificate of Fact – Standing | $15 |

| Name Reservation | $40 |

| Registered Agent Service | $50 – $300 |

| Operating Agreement | $0 – $2500 |

| Annual Report | None |

| Franchise Tax | varies |

| Business Licenses and Renewals | varies – check with state and local government |